Union Budget 2025

Part – 1: The status of the Indian Economy

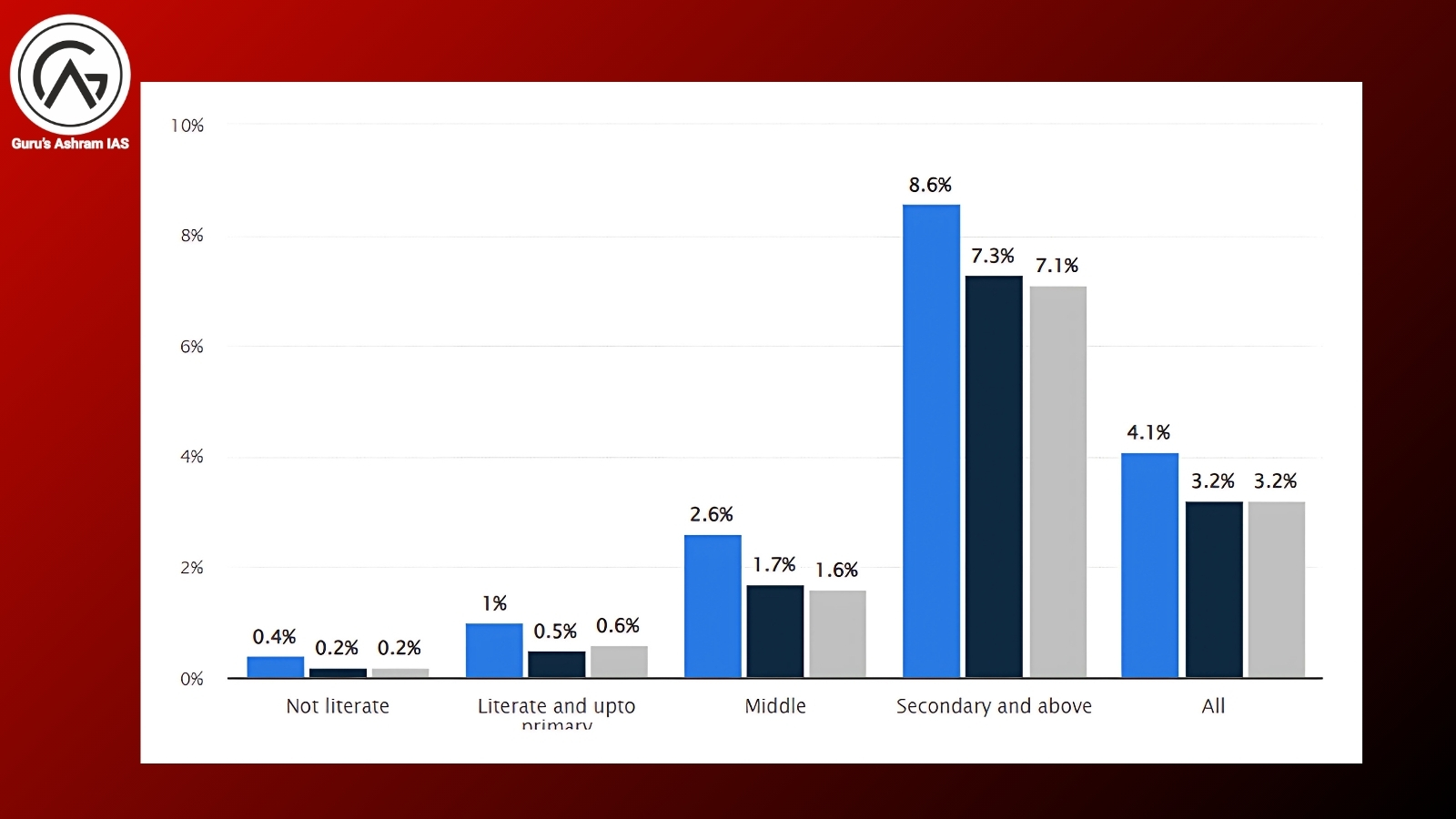

Issue No.1 – The unemployment:

Unemployment Rate in India increased to 8.30 percent in December from 8 percent in November of 2024. Unemployment Rate in India averaged 8.18 percent from 2018 until 2024, reaching an all-time high of 23.50 percent in April of 2020 and a record low of 6.40 percent in September of 2022, Union Budget 2025.

Issue No. 2 – Manufacturing in India:

Before the pandemic, the sector contributed 16-17% of India’s GDP, employing 27.3 million workers. The government envisions increasing this share to 25% by 2025. According to the New Indian Express report, the share of value addition by manufacturing sector is 15.9% in 2023-24. This is in spite of numerous government programmes like Semicon India programme to give an impetus to semiconductor manufacturing; production-linked scheme for 14 manufacturing sectors; National Single Window Programme to integrate clearances from 32 ministries/departments and 29 states/UTs, facilitating rapid approvals; PM Gati Shakti National Master Plan to reduce logistics cost; and National Industrial Corridor Development Programme.

Issue No.3 – Declining Household savings and rising debt:

The Reserve Bank of India reports highlight that India’s net household savings stood at a 47-year-old low at 5.3% of the GDP in 2023-24, down from 7.3% in 2022-23. More importantly, there has been a sharp jump in household debt at 5.8% of GDP – the second-highest level after the 1970s.

This could mean two things-

1) As finance ministry has highlighted that people were taking advantage of low interest rates after the pandemic to buy cars, education loans and homes. This shows the consumer confidence is high, and many Indians hope income growth will be strong enough in future.

2) As the economist Rathin Roy in this article in the Business Standard highlights that it could also highlight that inflation coupled with joblessness or catastrophic expenditure or poor wages is leading more debt and less savings. This could highlight serve distress.

Nonetheless, the decline in savings coupled with the increase in debt prompted concerns regarding “debt repayment and financial fragility”.

Issue No.4 – The declining Growth:

There is a downward trend behind GDP. The real GDP has fallen to 5.4 percent for the second quarter of 2024-25, from 8.1 percent in the previous year’s quarter. Worse, manufacturing has slowed down to dangerous levels: at 2.2 percent which is way below the 7 percent in the previous quarter and 14.3 percent in the second quarter of 2023-24.

Issue No.5 – The inequalities in India:

According to the Oxfam report top 10% of the Indian population holds 77% of the total national wealth. while 670 million Indians who comprise the poorest half of the population saw only a 1% increase in their wealth.

A simple illustration: It would take 941 years for a minimum wage worker in rural India to earn what the top paid executive at a leading Indian garment company earns in a year.

Issue No.6 – The tormented Middle-Class taxpayers:

There is a constituency of overburdened middle-class taxpayers with no recourse—they are not rich enough to live a dignified life, not poor enough to get doles, not corrupt enough to evade.

- Corporate income tax collections have grown from Rs. 5.56 lakh crore in 2019-20 to Rs. 10.2 lakh crore in 2024-25, an increase of 83%. During the same period, personal income tax collection grew from Rs. 4.92 lakh crore to Rs. 11.87 lakh crore, an increase of 141%. The PIT-to-CIT ratio, which was 0.7x from 2000-10 to 2019-20, has increased to 1.1x from 2020-21 to 2024-25 (budgeted).

- Annual GST collections in India range from Rs. 18 lakh crores to Rs. 20 lakh crores. Since corporations can claim input tax, most of the GST collections are paid by individuals.

A simple illustration: For an individual who earns Rs. 10 lakh and saves 30% (the national savings rate), the tax outgo, assuming an average GST rate of 15% on consumption, could be close to Rs. 1.6 lakh and 20% if there is no saving at all.

Similarly, if an individual earns Rs. 20 lakhs in income and saves 30%, assuming an average GST rate on their expenditure of 18%, he will pay Rs. 3.1 lakh in income tax under the new tax regime and Rs. 2 lakhs in GST on consumption expenditure. The total tax paid would be Rs. 5.1 lakh, or 25% of the income and 31% at no savings at all.

Issue no. 7: The corruption in India Economy:

The India Business Corruption Survey 2024 points out that in the past 12 months, 66 percent of businesses surveyed said they had to pay a bribe, 83 percent of which was paid in cash, with 54 percent being forced to do so.

Part – 2: Significant events in India’s Budget History —1947 to 2024

Finance Minister R.K. Shanmukham Chetty’s Budget 1947 celebrated freedom. Deputy Prime Minister and Finance Minister Indira Gandhi’s Budget 1969 extended the wealth tax to agriculture. In 1973, Finance Minister Y.B. Chavan’s Budget proposed a personal income tax rate taking the total marginal tax to an absurd 119 percent. Finance Minister Manmohan Singh’s Budget 1991 fanned the opening up of the economy. Finance Minister P. Chidambaram’s Budget 1997 (recorded as a “dream budget”) consolidated the three-slab personal income tax rates to an elegant 10, 20 and 30 percent structure. More recently, Nirmala Sitharaman’s Budget 2023 tripled capital investment in four years and laid the foundations for long-term growth.

Part – 3: The Budget 2025-26

Sub Part – A: Revised Estimates 2024-25

- The Revised Estimate of the total receipts other than borrowings is

` 31.47 lakh crore, of which the net tax receipts are ` 25.57 lakh crore. The Revised Estimate of the total expenditure is ` 47.16 lakh crore, of which the capital expenditure is about ` 10.18 lakh crore. - The Revised Estimate of the fiscal deficit is 4.8 per cent of GDP.

Sub Part – B: Budget Estimates 2025-26

- The total receipts other than borrowings and the total expenditure are estimated at ` 34.96 lakh crore and ` 50.65 lakh crore respectively.

- The net tax receipts are estimated at ` 28.37 lakh crore.

- The fiscal deficit is estimated to be 4.4 per cent of GDP.

- The net market borrowings from dated securities are estimated at ` 11.54 lakh crore. The balance financing is expected to come from small savings and other sources. The gross market borrowings are estimated at ` 14.82 lakh crore.

Sub Part – C: The Tax Proposals

Customs Tariff Structure for Industrial Goods:

- Remove seven tariff rates. After this, there will be only eight remaining tariff rates including ‘zero’ rate.

- Apply appropriate cess to broadly maintain effective duty incidence except on a few items, where such incidence will reduce marginally.

- Levy not more than one cess or surcharge. Therefore, I propose to exempt Social Welfare Surcharge on 82 tariff lines that are subject to a cess.

Relief on import of Drugs/Medicines:

- To provide relief to patients, particularly those suffering from cancer, rare diseases and other severe chronic diseases, it is proposed to add 36 lifesaving drugs and medicines to the list of medicines fully exempted from Basic Customs Duty (BCD).

- It is also proposed to add 6 lifesaving medicines to the list attracting concessional customs duty of 5%.

- Specified drugs and medicines under Patient Assistance Programmes run by pharmaceutical companies are fully exempt from BCD, provided the medicines are supplied free of cost to patients. I propose to add 37 more medicines along with 13 new patient assistance programmes.

Support to Domestic Manufacturing and Value addition

- Critical Minerals: full exemption to cobalt powder and waste, the scrap of lithium-ion battery, Lead, Zinc and 12 more critical minerals for CBD.

- Textiles: Two more types of shuttles-less looms are added to the list of fully exempted textile machinery.

o I also propose to revise the BCD rate on knitted fabrics covered by nine tariff lines from “10% or 20%” to “20% or ` 115 per kg, whichever is higher”.

Electronic Goods:

o I propose to increase the BCD on Interactive Flat Panel Display (IFPD) from 10% to 20% and reduce the BCD to 5% on Open Cell and other components.

o The BCD on the manufacture of Open Cells of LCD/LED TVs has been fully exempted.

- Lithium Ion Battery: To the list of exempted capital goods, I propose to add 35 additional capital goods for EV battery manufacturing, and 28 additional capital goods for mobile phone battery manufacturing.

- Shipping Sector: Proposed to continue the exemption of BCD on raw materials, components, consumables or parts for the manufacture of ships for another ten years. I also propose the same dispensation for ship breaking to make it more competitive.

- Telecommunication: To prevent classification disputes, I propose to reduce the BCD from 20% to 10% on Carrier Grade ethernet switches to make it at par with Non-Carrier Grade ethernet switches.

Export Promotion:

- Handicraft Goods: To facilitate exports of handicrafts, I propose to extend the time period for export from six months to one year, further extendable by another three months, if required. I also propose to add nine items to the list of duty-free inputs.

- Leather sector: I propose to fully exempt BCD on Wet Blue leather to facilitate imports for domestic value addition and employment. I also propose to exempt crust leather from 20% export duty to facilitate exports by small tanners.

- Marine products: I propose to reduce BCD from 30% to 5% on Frozen Fish Paste (Surimi) for manufacture and export of its analogue products. I also propose to reduce BCD from 15% to 5% on fish hydrolysate for manufacture of fish and shrimp feeds.

- Domestic MROs for Railway Goods: In July 2024 Budget, to promote development of domestic MROs for aircraft and ships, I had extended the time limit for export of foreign origin goods that were imported for repairs, from 6 months to one year and further extendable by one year. I now propose to extend the same dispensation for railway goods.

Trade facilitation:

- Time limit for Provisional Assessment: Presently, the Customs Act, 1962 does not provide any time limit to finalize Provisional Assessments leading to uncertainty and cost to trade. As a measure of promoting ease of doing business, I propose to fix a time-limit of two years, extendable by a year, for finalising the provisional assessment.

- Voluntary Compliance: I propose to introduce a new provision that will enable importers or exporters, after clearance of goods, to voluntarily declare material facts and pay duty with interest but without penalty. This will incentivise voluntary compliance. However, this will not apply in cases where department has already initiated audit or investigation proceedings.

- Extended Time for End Use: For industry to better plan their imports, I propose to extend the time limit for the end-use of imported inputs in the relevant rules, from six months to one year.

Personal Income Tax Reforms:

- There will be no income tax payable upto income of `12 lakh (i.e. average income of `1 lakh per month other than special rate income such as capital gains) under the new regime.

- This limit will be ` 12.75 lakh for salaried taxpayers, due to standard deduction of ` 75,000.

- In the new tax regime, the revised tax rate structure as follows:

| 0-4 lakh rupees | Nil |

| 4-8 lakh rupees | 5 percent |

| 8-12 lakh rupees | 10 percent |

| 12-16 lakh rupees | 15 percent |

| 16-20 lakh rupees | 20 percent |

| 20- 24 lakh rupees | 25 percent |

| Above 24 lakh rupees | 30 per cent |

As a result of these proposals, revenue of about ₹ 1 lakh crore in direct taxes and ₹ 2600 crore in indirect taxes will be forgone.

Sub Part – D: The programmes and Policies

The Focus of the budget:

- Accelerate growth,

- Secure inclusive development,

- Invigorate private sector investments,

- Uplift household sentiments, and

- Enhance spending power of India’s rising middle class.

The Budget theme: To create Viksit Bharat:

- Zero-poverty.

- Hundred per cent good quality school education.

- Access to high-quality, affordable, and comprehensive healthcare.

- Hundred per cent skilled labour with meaningful employment.

- Seventy per cent women in economic activities; and

- Farmers making our country the ‘food basket of the world’.

1. Agriculture

- Prime Minister Dhan-Dhaanya Krishi Yojana for developing Agri Districts: The programme will cover 100 districts with low productivity, moderate crop intensity and below-average credit parameters. It aims to (1) enhance agricultural productivity, (2) adopt crop diversification and sustainable agriculture practices, (3) augment post-harvest storage at the panchayat and block level, (4) improve irrigation facilities, and (5) facilitate availability of long-term and short-term credit. This programme is likely to help 1.7 crore farmers.

- Multi-sectoral ‘Rural Prosperity and Resilience’ programme for under-employment in agriculture through skilling, investment, technology, and invigorating the rural economy. The primary focus of the programme is rural women, young farmers, rural youth, marginal and small farmers, and landless families.

- National Mission for Edible Oilseed for achieving atmanirbhrata in edible oils. Now a new programme for a 6-year called as “Mission for Aatmanirbharta in Pulses” with a special focus on Tur, Urad and Masoor.

- A comprehensive programme for Vegetables & Fruits to promote production, efficient supplies, processing, and remunerative prices for farmers will be launched in partnership with states.

- Makhana Board will be established in the state of Bihar to improve production, processing, value addition, and marketing of makhana.

- National Mission on High Yielding Seeds

Fisheries

Enabling framework for sustainable harnessing of fisheries from Indian Exclusive Economic Zone and High Seas, with a special focus on the Andaman & Nicobar and Lakshadweep Islands.

Mission for Cotton Productivity

A 5-year mission to facilitate significant improvements in productivity and sustainability of cotton farming and promote extra-long staple cotton varieties in line with the integrated 5F vision for the textile sector.

Enhanced Credit through KCC

The loan limit under the Modified Interest Subvention Scheme will be enhanced from ` 3 lakh to 5 lakhs for loans taken through the KCC.

India Post as a Catalyst for the Rural Economy

India Post will also be transformed as a large public logistics organization. This will meet the rising needs of Viswakarmas, new entrepreneurs, women, self-help groups, MSMEs, and large business organizations.

2. MSMEs

The current number of MSMEs in India are around 5.7 crore with over 1 crore registered MSMEs, employing 7.5 crore people. It generates around 36% of India’s manufacturing and are responsible for 45 per cent of India’s exports.

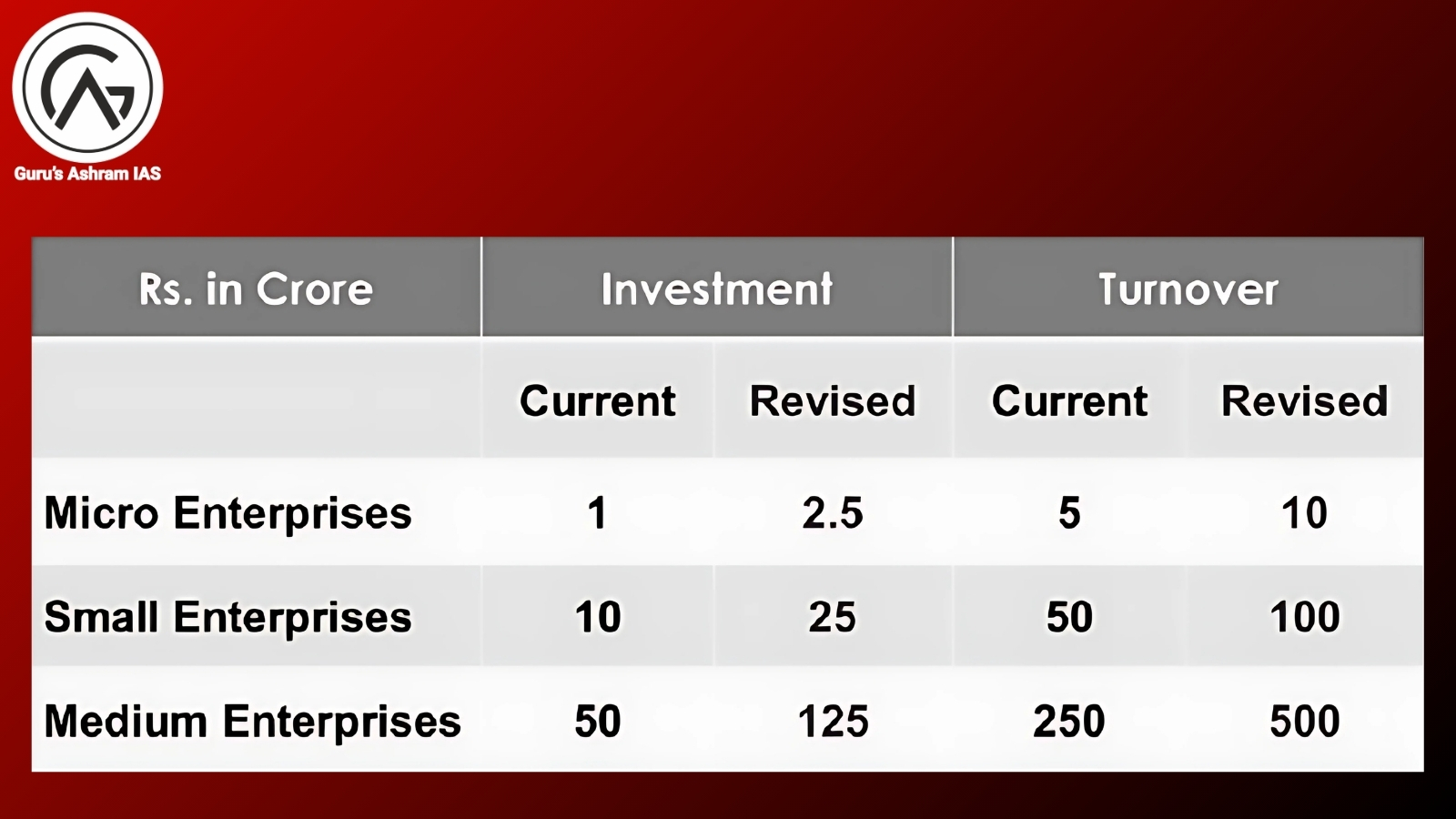

Revision in classification criteria for MSMEs:

Credit availability with guaranteed cover: The credit guarantee cover will be enhanced:

- For Micro and Small Enterprises, from ` 5 crore to 10 crores, leading to additional credit of ` 1.5 lakh crore in the next 5 years.

- For Startups, from ` 10 crore to 20 crores, with the guaranteed fee being moderated to 1 per cent for loans in 27 focus sectors important for Atmanirbhar Bharat; and

- For well-run exporter MSMEs, for term loans up to ` 20 crore.

Credit Cards for Micro Enterprises:

The Credit Cards with a ` 5 lakh limit for micro enterprises registered on Udyam portal. In the first year, 10 lakh such cards will be issued.

Fund of Funds for Startups

The Fund of Funds set up with a government contribution of ` 10,000 crore. Now, a new Fund of Funds, with expanded scope and a fresh contribution of another

` 10,000 crore will be set up.

Scheme for First-time Entrepreneurs:

- A new follow up scheme of Stand-up India for women, Scheduled Castes and Scheduled Tribes first-time entrepreneurs to provide a term loans up to ` 2 crore during the next 5 years.

- Measures for Labour-Intensive Sectors: (Not Yet Declared)

- Focus Product Scheme for Footwear & Leather Sectors (Not Yet Declared)

- National Institute of Food Technology, Entrepreneurship and Management in Bihar.

- National Manufacturing Mission covering small, medium and large industries for furthering “Make in India” by providing policy support, execution roadmaps, governance and monitoring framework for central ministries and states. (Details not available in the budget)

- The Mission for Clean Tech manufacturing to improve domestic value addition and build ecosystem for solar PV cells, EV batteries, motors and controllers, electrolyzers, wind turbines, very high voltage transmission equipment and grid scale batteries. (Details not available in the budget)

3. Investment

A) People Oriented Schemes/Programmes:

- Saksham Anganwadi and Poshan 2.0: The Saksham Anganwadi and Poshan 2.0 programme provides nutritional support to more than 8 crore children, 1 crore pregnant women and lactating mothers all over the country, and about 20 lakh adolescent girls in aspirational districts and the north-east region. The cost norms for the nutritional support will be enhanced appropriately.

- Atal Tinkering Labs: Fifty thousand Atal Tinkering Labs will be set up in Government schools in next 5 years.

- Broadband connectivity will be provided to all Government secondary schools and primary health centres in rural areas under the Bharat net project.

- Bharatiya Bhasha Pustak Scheme to provide digital-form Indian language books for school and higher education.

- National Centres of Excellence for Skilling: Five National Centres of Excellence for skilling will be set up with global expertise and partnerships to equip our youth with the skills required for “Make for India, Make for the World” manufacturing.

- Expansion of Capacity in IITs: Additional infrastructure will be created in the 5 IITs started after 2014 to facilitate education for 6,500 more students. Hostel and other infrastructure capacity at IIT, Patna will also be expanded.

- A Centre of Excellence in Artificial Intelligence for education will be set up with a total outlay of ` 500 crore.

- Expansion of medical education: In the next year, 10,000 additional seats will be added in medical colleges and hospitals, towards the goal of adding 75,000 seats in the next 5 years.

- Day Care Cancer Centres in all District Hospitals in the next 3 years.

- A scheme for socio-economic upliftment of urban workers (Details not available in the budget)

- PM SVANidhi: The scheme will be revamped with enhanced loans from banks, UPI linked credit cards with ` 30,000 limit, and capacity building support.

- Social Security Scheme for Welfare of Online Platform Workers: Government will arrange for their identity cards and registration on the e-Shram portal. They will be provided healthcare under PM Jan Arogya Yojana.

B) Investing in the Economy:

Public Private Partnership in Infrastructure: Each infrastructure-related ministry will come up with a 3-year pipeline of projects that can be implemented in PPP mode.

Support to States for Infrastructure: An outlay of ` 1.5 lakh crore is proposed for the 50-year interest free loans to states for capital expenditure and incentives for reforms.

Asset Monetization Plan 2025-30:

- Building on the success of the first Asset Monetization Plan announced in 2021, the second Plan for 2025-30 will be launched to plough back capital of ` 10 lakh crore in new projects. (Details not available in the budget)

Jal Jeevan Mission:

- Since 2019, 80 per cent of India’s rural population have been provided access to potable tap water connections. To achieve 100 per cent coverage, I am pleased to announce the extension of the Mission until 2028 with an enhanced total outlay.

Urban Challenge Fund:

The Government will set up an Urban Challenge Fund of ` 1 lakh crore to implement the proposals for ‘Cities as Growth Hubs’, ‘Creative Redevelopment of Cities’ and ‘Water and Sanitation’.

- This fund will finance up to 25 per cent of the cost of bankable projects with a stipulation that at least 50 per cent of the cost is funded from bonds, bank loans, and PPPs.

Power Sector Reforms: Additional borrowing of 0.5 per cent of GSDP will be allowed to state, contingent on they bring desirable reforms in their state discoms.

Nuclear Energy Mission for Viksit Bharat:

- With the target of at least 100 GW of nuclear energy by 2047, amendments to the Atomic Energy Act and the Civil Liability for Nuclear Damage Act will be taken up.

- Nuclear Energy Mission for research & development of Small Modular Reactors (SMR) with an outlay of ` 20,000 crore will be set up. At least 5 indigenously developed SMRs will be operationalized by 2033.

Shipbuilding:

- Credit Notes for shipbreaking in Indian yards to promote the circular economy.

- Large ships above a specified size will be included in the infrastructure harmonized master list (HML).

- Shipbuilding Clusters will be facilitated to increase the range, categories and capacity of ships. This will include additional infrastructure facilities, skilling and technology to develop the entire ecosystem.

A Maritime Development Fund with a corpus of ` 25,000 crore will be set up for distributed support and promoting competition. This will have up to 49 per cent contribution by the Government, and the balance will be mobilized from ports and private sector.

UDAN – Regional Connectivity Scheme:

A modified UDAN scheme will be launched to enhance regional connectivity to 120 new destinations and carry 4 crore passengers in the next 10 years. The scheme will also support helipads and smaller airports in hilly, aspirational, and Northeast region districts.

Greenfield Airport in Bihar:

Greenfield airports in addition to the expansion of the capacity of Patna airport and a brownfield airport at Bihta.

Western Koshi Canal Project in Mithilanchal:

Financial support for the Western Koshi Canal ERM Project benefitting many farmers cultivating over 50,000 hectares of land in the Mithilanchal region of Bihar.

Mining Sector Reforms: (Details not available in the budget)

- Mining sector reforms, including those for minor minerals, will be encouraged through sharing of best practices and institution of a State Mining Index.

- A policy for recovery of critical minerals from tailings will be brought out.

SWAMIH Fund 2

Under the Special Window for Affordable and Mid-Income Housing (SWAMIH) fifty thousand dwelling units in stressed housing projects have been completed, and keys handed over to homebuyers. SWAMIH Fund 2 of ` 15,000 crore will be established as a blended finances from the Government, banks and private investors for additional 1 lakh units.

PM Gati Shakti Data for Private Sector:

For furthering PPPs and assisting the private sector in project planning, access to relevant data and maps from the PM Gati Shakti portal will be provided.

Tourism for employment-led growth:

Top 50 tourist destination sites in the country will be developed in partnership with states through a challenge mode. The following measures will be taken for facilitating employment-led growth:

- Organizing intensive skill-development programmes for our youth including in Institutes of Hospitality Management.

- Providing MUDRA loans for homestays.

- Improving ease of travel and connectivity to tourist destinations.

- Providing performance-linked incentives to states for effective destination management including tourist amenities, cleanliness, and marketing efforts; and

- Introducing streamlined e-visa facilities along with visa-fee waivers for certain tourist groups.

Continuing with the emphasis on places of spiritual and religious significance in the July Budget, there will be a special focus on destinations related to the life and times of Lord Buddha.

C) Investing in Innovation

Research, Development and Innovation:

- 20,000 crore rupees fund to promote private sector driven Research, Development and Innovation

- A Deep Tech Fund of Funds will also be explored to catalyse the next generation startups.

PM Research Fellowship:

- Ten thousand fellowships for technological research in IITs and IISc with enhanced financial support.

Gene Bank for Crops Germplasm:

- The 2nd Gene Bank with 10 lakh germplasm lines will be set up for future food and nutritional security. This will provide conservation support to both public and private sectors for genetic resources.

National Geospatial Mission

- To develop foundational geospatial infrastructure and data. Using PM Gati Shakti, this Mission will facilitate modernization of land records, urban planning, and design of infrastructure projects.

- Gyan Bharatam Mission for survey, documentation and conservation of our manuscript heritage with academic institutions, museums, libraries and private collectors will be undertaken to cover more than 1 crore manuscripts. We will set up a National Digital Repository of Indian knowledge systems for knowledge sharing.

4. Exports

Export Promotion Mission:

- It will be driven jointly by the Ministries of Commerce, MSME, and Finance. It will facilitate easy access to export credit, cross-border factoring support, and support to MSMEs to tackle non-tariff measures in overseas markets.

Bharat TradeNet

- A digital public infrastructure, ‘BharatTradeNet’ (BTN) for international trade will be set-up as a unified platform for trade documentation and financing solutions. This will complement the Unified Logistics Interface Platform.

Support for integration with Global Supply Chains

- Support will be provided to develop domestic manufacturing capacities for our economy’s integration with global supply chains. Sectors will be identified based on objective criteria.

- Facilitation groups with participation of senior officers and industry representatives will be formed for select products and supply chains.

National Framework for GCC:

- A national framework will be formulated as guidance to states for promoting Global Capability Centres in emerging tier 2 cities. This will suggest measures for enhancing availability of talent and infrastructure, building-byelaw reforms, and mechanisms for collaboration with industry.

5. Reforms

Financial Sector Reforms and Development:

- FDI in Insurance Sector: The FDI limit for the insurance sector will be raised from 74 to 100 per cent for those companies which invest the entire premium in India. The current guardrails and conditionalities associated with foreign investment will be reviewed and simplified.

Expanding Services of India Post Payment Bank.

- Credit Enhancement Facility by NaBFID: NaBFID will set up a ‘Partial Credit Enhancement Facility’ for corporate bonds for infrastructure.

- Grameen Credit Score: Public Sector Banks will develop ‘Grameen Credit Score’ framework to serve the credit needs of SHG members and people in rural areas.

- Pension Sector: A forum for regulatory coordination and development of pension products will be set up.

- KYC Simplification: To simplify the KYC process, the revamped Central KYC Registry will be rolled out in 2025.

- Merger of Companies: The scope for fast-track mergers will also be widened and the process made simpler.

- Bilateral Investment Treaties: To encourage sustained foreign investment and in the spirit of ‘first develop India’, the current model BIT will be revamped and made more investor friendly.

Regulatory Reforms:

- High Level Committee for Regulatory Reforms to review all non-financial sector regulations, certifications, licenses, and permissions.

- Investment Friendliness Index of States will be launched in 2025 to further the spirit of competitive cooperative federalism.

- FSDC (Financial Stability and Development Council), a mechanism will be set up to evaluate impact of the current financial regulations and subsidiary instructions. It will also formulate a framework to enhance their responsiveness and development of the financial sector.

- Jan Vishwas Bill 2.0: In the Jan Vishwas Act 2023, more than 180 legal provisions were decriminalized. Our government will now bring up the Jan Vishwas Bill 2.0 to decriminalize more than 100 provisions in various laws.