Union Budget 2024 – 25

About Government Budgeting:

It entails projecting government income (from taxes, fees, and other sources) and choosing the spending required to meet the goals of government policy within a certain fiscal year, which is typically one year.

India’s Union Budget:

According to Article 112 of the Indian Constitution, the Union Budget is the Union Government’s yearly financial statement for a specific fiscal year. It includes a thorough breakdown of the government’s anticipated income and outlays for the specific fiscal year, (usually from April 1 to March 31). It contains the following three information:

- Budgetary estimates of income and expenses for the forthcoming fiscal year, also referred to as the “Budget Year”.

- Updated revenue and expense estimates for the current fiscal year.

- Provisional figures for previous fiscal year’s revenues and outlays.

Click Here To Download PDF Union Budget UPSC pdf

Some facts about the budget of India:

The Union Finance Minister presents the Union Budget on February 1st of each year starting since the budget 2017–18. It was in contrast with the colonial tradition of delivering budget in the final week of February.

Since the 2017–18 fiscal year, the Railway Budget has been combined with the General Budget under the Bibek Debroy Committee’s suggestion. It was in contrast with tradition developed with the advice of the Acworth Committee, when the Britishers divided the Railway Budget from the General Budget in 1924.

The Department of Economic Affairs’ (Ministry of Finance) Budget Division is the key institution for creating the Union Budget.

Part 1: The Status of Indian Economy

In the 26th January speech India’s Prime Minister talked about the idea of “Viksit Bharat 2047.” This entail analysing the hits and the misses of the economy so far, particularly the past year, before analysing this year’s budget.

The hits of the Indian economy so far are:-

- India has surpassed the UK as the fifth largest economy in 2023 (about $3.7 trillion) from about $2 trillion in 2014 and according to Morgan Stanley, it is on track to overtake Japan and Germany and hit the third spot by 2027.

- India’s push for digital governance has been miracle for the Indian economy, empowered by the three-layer system of governance, which includes

-

Universal identity cards

-

A payments infrastructure that e UPSCables click-of-a-button money transfer

-

A data pillar that gives people access to crucial personal documents like tax returns.

- Modi’s economic policy has spent over $100bn annually in infrastructure spending (capital expenditure) in the past three years, as the part of PM Gati Shakti Programme, leading to creation of new roads, airports, ports and metros. For example, nearly 54,000 km of national highways were built between 2014 and 2024 – which is twice the length of the preceding 10 years.

- The proportion of Indian villages with access to electricity climbed from 88% in 2014 to 99.6% in 2020. And 71.1% of people in India now own an account at a financial institution, up from 48.3% in 2014.

- India’s inflation continues to be low, stable and moving towards the 4 % target. Core inflation (non-food, non-fuel) currently is 3.1 per cent.

The biggest problems/misses of India economy are: –

- Unemployment Conundrum: According to the India Employment Report 2024, created jointly by the Institute for Human Development and the International Labour Organisation (ILO), India’s working population increased from 61 percent in 2011 to 64 percent in 2021, and it is projected to reach 65 percent in 2036. However, youth involvement in economic activities declined to 37 percent in 2022. According to the latest data from the Centre for Monitoring Indian Economy (CMIE), the unemployment rate in India stood at 9.2 percent in June 2024, a sharp increase from 7 percent in May 2024.

Unemployment Rate Data

Year |

Unemployment Rate (percent) |

|---|---|

2024 |

9.2 (June 2024) |

2023 |

8.003 |

2022 |

7.33 |

2021 |

5.98 |

2020 |

8.00 |

2019 |

5.27 |

2018 |

5.33 |

2017 |

5.36 |

2016 |

5.42 |

2015 |

5.44 |

2014 |

5.44 |

- Destruction of India’s informal economy (unorganised sector) by brutal lockdowns imposed during the pandemic, the after-effects of a Note Bandi (Cash Ban) in 2016, and faulty implementation of a new goods and services tax. This is also a reason of rising unemployment and inequalities.

- No significant growth of real wages in India: Using the figures from the Labour Bureau and the RBI handbook of Statistics on Indian States, economist Jean Dreze argues that there has been no significant growth of real wages in India since 2014. Precisely the growth rate of real wages between 2014-15 and 2021-22 was below 1 per cent per year across the board. This is a better measure of development.

Note: A sustained rise in real wages means that economic growth is translating into better jobs. Stagnation of real wages, on the other hand, means that economic growth is not translating into better jobs, meaning poverty reduction is not happening.

- The overall private consumption expenditure (money people spend on buying things) has grown by 3%. It is the slowest in 20 years. Private final consumption expenditure dropped steadily from nearly 90% of GDP in 1950-51 to hit a low of 54.7% of GDP in 2010-11.

- The household debt has touched an all-time high, even as financial savings plunged to their lowest levels. For example, from 2016-17 to 2021-22, outstanding personal loans from banks more than doubled, increasing from INR 16.2 trillion to INR 33.85 trillion.

- Private investment (GFCF) witnessed a steady decline since 2011-12 (lockdowns, corona, GST, Ukraine war). From independence to economic liberalisation, private investment largely remained either slightly below or above 10% of the GDP. Public investment steadily rose from less than 3% of GDP in 1950-51 to overtake private investment as a percentage of GDP in the early 1980s. It, however, began to drop post-liberalisation and at the same time private investment grew from 10% to around 27% in 2007-08. From 2011-12 onwards, however, private investment began to drop and hit a low of 19.6% of the GDP in 2020-21.

Note: Gross Fixed Capital Formation (GFCF) refers to the growth in the size of fixed capital in an economy such as buildings and machinery. Generally, developed economies such as the U.S. possess more fixed capital per capita than developing economies such as India.

- Manufacturing’s share as a percentage of GDP has remained stagnant in the last decade. The manufacturing’s share in GDP went up from 9% in 1950-51 to 15.2% in 1989-90 but has been stagnate around 15% since 1991. In Modi government’s tenure it has declined from 16% in 2014 to 13% in 2023-24.

- According to World Inequality Database, the Inequalities in India has widened to a hundred-year high. The vivid example is the marriage of Indian billionaire Mukesh Ambani’s son. According to the Oxfam’s ‘Survival of the Richest’ report, the richest 1% of Indians currently controls more than 40% of the nation’s overall wealth, while the poorest 50% of the population collectively own just 3% of the country’s wealth.

The strength India still possesses to alleviate its economy and people:

- A young demographic.

- The geopolitics of global de-risking from China (China plus one strategy).

- A clean-up of sectors like real estate.

- Megatrends like digitalisation, a transition to clean energy and growth in global offshoring.

- The infra push in improvements in roads, power supply and turnaround time at ports.

What need to be done for all the problems mentioned above?

- According to Jene Dreze, there is a need to reorient of economic policies, with more focus on the drivers of wage growth.

- Supporting the manufacturing in labour-intensive sectors such as apparel, leather, tourism, and hospitality through mechanisms like the production-linked incentive scheme.

- The budget must increase spending to at least 3% of GDP on healthcare and 6% on education because both has direct impact on savings, employability and poverty.

- According to India Author “Gurcharan Das” India need the Industrial Revolution (Manufacturing) to deal with most of the problems of Indian Economy.

Economic Survey’s Chapter 5 talks about the six-pronged strategy:

- Human capital development through three verticals, namely, generating productive employment, reducing the skill gap, and enhancing the health of the youth.

- Tapping the full potential of the agriculture sector.

- Easing compliance requirements and financing bottlenecks for MSMEs.

- Managing India’s green transition.

- Addressing the Chinese challenge in the global value chain.

- Deepening the corporate bond market.

- Reducing inequality.

Part – 2: The Key Highlights of the Union Budget

Sub Part A – The budget estimates 2024-25:

- The total receipts other than borrowings Rs 32.07 lakh crore.

- The total expenditure Rs 48.21 lakh crore.

- The net tax receipts Rs 25.83 lakh crore.

- The fiscal deficit 4.9 per cent of GDP (down to 0.7%)

- The Revenue Deficit 1.8 per cent (down to 0.8%)

- The gross market borrowings through dated securities Rs 14.01 lakh crore.

- The net market borrowings through dated securities Rs 11.63 lakh crore.

Next year Fiscal Deficit Target below 4.5 per cent.

Context: The growth of income tax on individuals, at 15.4 percent to INR 11.9 lakh crore has grown faster than even the Sensex and has surpassed the INR 10.2 lakh crore corporation tax.

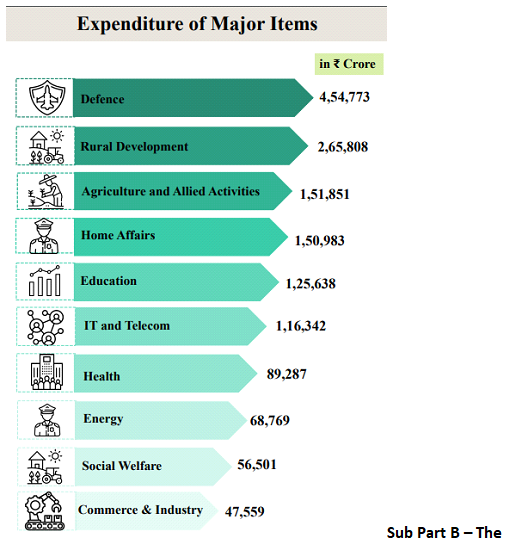

Sub Part B – The proposals in the budget:

This budget envisages sustained efforts on the following 9 priorities for generating ample opportunities for all.

- Productivity and resilience in Agriculture

- Employment & Skilling

- Inclusive Human Resource Development and Social Justice

- Manufacturing & Services

- Urban Development

- Energy Security

- Infrastructure

- Innovation, Research & Development

- Next Generation Reforms.

Priority 1: Agriculture (provision of ₹ 1.52 lakh crore for agriculture and allied sector)

- Agriculture Research to bring the focus on raising productivity and developing climate resilient varieties. Funding will be provided in challenge mode, including to the private sector.

- New 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops will be released for cultivation by farmers.

- In the next two years, 1 crore farmers across the country will be initiated into natural farming supported by certification and branding.

- For achieving self-sufficiency in pulses and oilseeds such as mustard, groundnut, sesame, soybean, and sunflower by strengthening their production, storage, and marketing.

- Large scale clusters for vegetable production will be developed closer to major consumption centres with focus on vegetable supply chains including for collection, storage, and marketing.

- Digital Public Infrastructure (DPI) in agriculture including the digital crop survey for Kharif, details of 6 crore farmers and their lands will be brought into the farmer and land registries and issuance of Jan Samarth based Kisan Credit Cards in 5 states.

Cooperatives:

- Our government will bring out a National Cooperation Policy for systematic, orderly, and all-round development of the cooperative sector.

Priority 2: Employment & Skilling

- Employment Linked Incentive Scheme as part of the Prime Minister’s package:

- Scheme A – First Timers: This scheme will provide one-month wage upto 15k to all first-time employees, as registered in the EPFO, in all formal sectors having salary upto 1 lakh per month.

- Scheme B – Job Creation in manufacturing: This scheme will incentivize additional employment in the manufacturing sector by providing a part of their EPFO contribution directly both to the employee and the employer in the first 4 years of employment.

- Scheme C – Support to employers: The government will reimburse to employers up to Rs. 3,000 per month for 2 years towards their EPFO contribution for each additional employee in all sectors having income upto Rs 1 lakh/Month.

Women In Workforce:

-

Government will set up working women hostels in collaboration with industry and establishing creches.

-

Government will seek to organize women-specific skilling programmes, and promotion of market access for women SHG enterprises.

Skill Development:

- A new centrally sponsored scheme for skilling the youth in collaboration with state governments and Industry.

- Industrial Training Institutes (ITIs) will be upgraded in hub and spoke arrangements with outcome orientation.

- Course content and design will be aligned to the skill needs of industry, and new courses will be introduced for emerging needs.

- The Model Skill Loan Scheme will be revised to facilitate loans up to Rs. 7.5 lakh with a guarantee from the government.

- Education Loans upto Rs 10 lakh for higher education in domestic institutions with annual interest subvention of 3% of the loan amount.

Priority 3 – Inclusive Human Resource Development and Social Justice:

- Implementation of schemes meant for supporting economic activities by craftsmen, artisans, self-help groups, scheduled caste, schedule tribe and women entrepreneurs, and street vendors, such as PM Vishwakarma, PM SVANidhi, National Livelihood Missions, and Stand-Up India will be stepped up.

- Purvodaya Scheme for the all-round development of the eastern region of the country covering Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh.

- Amritsar Kolkata Industrial Corridor, we will support development of an industrial node at Gaya.

The Bihar Chapter:

- Development of road connectivity projects, namely (1) Patna-Purnea Expressway, (2) Buxar-Bhagalpur Expressway, (3) Bodhgaya, Rajgir, Vaishali and Darbhanga spurs, and (4) additional 2-lane bridge over river Ganga at Buxar.

- Power projects, new airports, medical colleges and sports infrastructure in Bihar will be constructed.

- An additional allocation to support capital investments and support for external assistance from multilateral development banks.

The Andhra Pradesh Chapter:

- Special financial support through multilateral development agencies for the new capital.

- Full commitment to financing and early completion of the Polavaram Irrigation Project.

- Funds will be provided for essential infrastructure such as water, power, railways and roads in on the Vishakhapatnam-Chennai Industrial Corridor and Hyderabad-Bengaluru Industrial Corridor.

- Grants for backward regions of Rayalaseema, Prakasam and North Coastal Andhra will also be provided.

New Scheme:

- Pradhan Mantri Janjatiya Unnat Gram Abhiyan for improving the socio-economic condition of tribal communities by adopting saturation coverage for tribal families in tribal-majority villages and aspirational districts.

Priority 4 – Manufacturing & Services:

Following specific measures have been announced for promotion of MSME: –

- Credit Guarantee Scheme for MSMEs in the Manufacturing Sector: Facilitating term loans to MSMEs for purchase of machinery and equipment without collateral or third-party guarantee. A Self-financing guarantee fund will provide guarantee cover up to Rs 100 crore to each applicant. The borrower will have to provide an upfront guarantee fee and an annual guarantee fee on the reducing loan balance.

- Public sector banks will build their in-house capability to assess MSMEs for credit, instead of relying on external assessment. They will also develop a new model for assessment of the MSMEs including scoring of digital footprints of MSMEs.

- A government promoted fund to provide additional capital to MSMEs while they are in the ‘special mention account’ (SMA) stage for reasons beyond their control. This is to avoid getting into the NPA stage.

- The limit of Mudra loans will be enhanced to ₹ 20 lakh from the current ₹ 10 lakh for those entrepreneurs who have availed and successfully repaid previous loans under the ‘Tarun’ category.

- The turnover threshold of MSMEs for mandatory onboarding on the Trade Receivables electronic Discounting System (TReDS) platform has been reduced from Rs 500 crore to Rs 250 crore.

- Small Industries Development Bank of India (SIDBI) will open new branches to expand its reach to serve all major MSME clusters within 3 years to provide direct loans to them.

- New MSME units proposed for food irradiation, quality & safety testing.

- E-Commerce Export Hubs to enable MSMEs and traditional artisans to sell their products in international markets.

Internship:

Under the Prime Minister’s package, government will launch a comprehensive scheme for providing internship opportunities in 500 top companies to 1 crore youth in 5 years for 12 months with internship allowance of Rs 5,000 per month along with a one-time assistance of Rs 6,000.

Industrial Parks: Government will facilitate development of investment-ready “plug and play” industrial parks with complete infrastructure and 12 industrial parks under the National Industrial Corridor Development Programme.

Minerals:

- Critical Mineral Mission for domestic production, recycling of critical minerals, and overseas acquisition of critical mineral assets.

- Government will auction the first tranche of offshore blocks for mining.

Easy Resolution of Firms:

- Integrated Technology Platform for IBC eco-system improving the outcomes under the Insolvency and Bankruptcy Code (IBC) by achieving better transparency, timely processing and better oversight for all stakeholders.

- The services of the Centre for Processing Accelerated Corporate Exit (C-PACE) will be extended for voluntary closure of LLPs to reduce the closure time.

- Appropriate changes to the IBC, reforms and strengthening of the tribunal and appellate tribunals will be initiated to speed up insolvency resolution. Additional tribunals will be established.

Priority 5 – Urban Development:

- Cities as Growth Hubs through economic and transit planning, and orderly development of peri-urban areas.

- Creative redevelopment of cities.

- Transit Oriented Development

- Urban Housing for poor under the PM Awas Yojana Urban 2.0.

- Promotion of water supply, sewage treatment and solid waste management projects and services for 100 large cities.

- Lowering high stamp duty to moderate the rates for all, and further lowering duties for properties purchased by women.

Priority 6 – Energy Security:

- PM Surya Ghar Muft Bijli Yojana has been launched to install rooftop solar plants to enable 1 crore households obtain free electricity up to 300 units every month.

- A policy for promoting pumped storage projects for electricity storage and smooth integration of the renewable energy in the overall energy mix.

- Government will partner with the private sector for setting up Bharat Small Reactors and other associated research.

- A roadmap for the ‘hard to abate’ industries to move from ‘energy efficiency’ targets to ‘emission targets’ by changing the current ‘Perform, Achieve and Trade’ mode to ‘Indian Carbon Market’ mode.

Priority 7 – Infrastructure:

- The budget has provided Rs.11.11 lakh crore for capital expenditure (about 3.4 per cent of GDP).

- A provision of Rs. 1.5 lakh crore for long-term interest free loans to the states for development of infrastructure.

- Private Infrastructure Investment will be promoted through viability gap funding and enabling policies and regulations including a market based financing framework.

- (PMGSY) will be launched to provide all-weather connectivity to 25,000 rural habitations.

- Flood related assistance to Bihar, Himachal Pradesh, Uttarakhand and Sikkim.

Tourism:

- Comprehensive development of Vishnupad Temple Corridor and Mahabodhi Temple Corridor on the line of Kashi Vishwanath Temple Corridor.

- A comprehensive development initiative for Rajgir and the development of Nalanda as a tourist centre besides reviving Nalanda University.

- Assistance for the development of Odisha’s tourist infrastructure.

Priority 8 – Innovation, Research & Development:

- The Anusandhan National Research Fund for basic research and prototype development and a financing pool of Rs 1 lakh crore to push private sector-driven research and innovation.

- A venture capital fund of Rs 1,000 crore for Space Exploration.

Priority 9 – Next Generation Reforms:

- The government will initiate and incentivize reforms for (1) improving productivity of factors of production, and (2) facilitating markets and sectors to become more efficient.

- The push of reforms for the state government:

-

Land-related reforms and actions, both in rural and urban areas, will cover (1) land administration, planning and management, and (2) urban planning, usage and building bylaws.

-

Rural land related actions will include (1) assignment of Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar for all lands, (2) digitization of cadastral maps, (3) survey of map sub-divisions as per current ownership, (4) establishment of land registry, and (5) linking to the farmers registry.

-

Land records in urban areas will be digitized with GIS mapping.

- A comprehensive integration of e-shram portal with other portals for various services like employment and skilling and strengthening of Shram Suvidha and Samadhan portals.

- The rules and regulations for Foreign Direct Investment and Overseas Investments will be simplified to facilitate foreign direct investments, especially using Indian Rupee as a currency for overseas investments.

- NPS Vatsalya will get contribution by parents and guardians for minors. On attaining the age of majority, the plan can be converted seamlessly into a normal NPS account.

- For enhancing ‘Ease of Doing Business’, government will bring the Jan Vishwas Bill 2.0.

Sub Part C – The Tax Proposal:

Indirect Taxes:

- Government will undertake a comprehensive review of the customs duty rates over the next 6 months to rationalise and simplify it for ease of trade, removal of duty inversion and reduction of disputes.

- Three more medicines for cancer are exempted from customs duties and changing the Basic Customs Duty (BCD) on x-ray tubes & flat panel detectors used in medical x-ray machines under the Phased Manufacturing Programme (PMP).

- Reduction of the BCD on mobile phone, mobile PCBA and mobile charger to 15 per cent.

- Full exemption on customs duties on 25 critical minerals and reduce BCD on two others, especially on the minerals such as lithium, copper, cobalt and rare earth elements, which are critical for sectors like nuclear energy, renewable energy, space, defence, telecommunications, and high-tech electronics.

- A list of capital goods used in the manufacture of solar cells and panels in the country are exempted from customs while solar glass and tinned copper interconnect will not be exempted from customs duties.

- Reduction of BCD on certain broodstock, polychaete worms, shrimp and fish feed to 5 per cent.

- Reduction of customs duties on gold and silver to 6 per cent and that on platinum to 6.4 per cent.

- Removal of BCD on ferro nickel and blister copper, used in production of Steel and copper.

Direct Taxes: 58% of corporate tax came from the simplified tax regime in financial year 2022-23. Similarly, more than two thirds have availed the new personal income tax regime. The proposals for the direct taxes are –

- Government will carry out a comprehensive review of the Income-tax Act, 1961 to reduce disputes and litigation, and bring tax certainty.

- The two tax exemption regimes for charities are to be merged into one.

- The 20 per cent TDS rate on repurchase of units by mutual funds or UTI is being withdrawn.

- TDS rate on e-commerce operators is proposed to be reduced from one to 0.1 per cent.

- Decriminalization of delay for payment of TDS up to the due date of filing statement.

- An assessment can be reopened beyond three years from the end of the assessment year only if the escaped income is ₹ 50 lakh or more, up to a maximum period of five years from the end of the assessment year.

- Even in search cases, a time limit of six years before the year of search, as against the existing time limit of ten years.

- Short term capital gains (STCG) on certain financial assets have been increased to 20 %, while that on all other financial assets and all non-financial assets shall continue to attract 15%.

- Long term capital gains (LTFG) on all financial and non-financial assets, has been increased to 12.5% from 10%.

- There is a proposal to increase the limit of exemption of capital gains on listed equity and equity oriented mutual funds to Rs 1.25 lakh per year from Rs 1 lakh currently.

Note: Listed financial assets held for more than a year will be classified as long term, while unlisted financial assets and all non-financial assets will have to be held for at least two years to be classified as long-term.

- Unlisted bonds and debentures, debt mutual funds and market linked debentures, irrespective of holding period will attract tax on capital gains at applicable rates.

- For resolution of certain income tax disputes pending in appeal, I am also proposing Vivad Se Vishwas Scheme, 2024.

- Increase in monetary limits for filing appeals related to direct taxes, excise and service tax in the Tax Tribunals, High Courts and Supreme Court to ₹ 60 lakh, ₹ 2 crore and ₹ 5 crore respectively.

- Government will expand the scope of safe harbour rules streamline the transfer pricing assessment procedure.

- Withdrawal of equalization levy of 2 per cent

- Expansion of tax benefits to certain funds and entities in IFSCs

- Immunity from penalty and prosecution to benamidar on full and true disclosure so as to improve conviction under the Benami Transactions (Prohibition) Act, 1988.

Employment and Investment: To promote investment and foster employment, government has come up with following proposals:

- Government has abolished the angel tax for all classes of investors.

- A simpler tax regime for foreign shipping companies operating domestic cruises in the country.

- Safe harbour rates for foreign mining companies selling raw diamonds in the country.

- To attract foreign capital, corporate tax rate on foreign companies has been reduced from 40 to 35 %.

Deepening the tax base:

- Security Transactions Tax (STT) on futures and options is proposed to be increased to 0.02 per cent and 0.1 per cent respectively.

- Income received on buy back of shares will be taxed.

Social Security:

- Employers’ contribution towards NPS is proposed to be increased from 10 to 14 per cent of the employee’s salary.

- Deduction of this expenditure up to 14 per cent of salary from the income of employees in private sector, public sector banks and undertakings, opting for the new tax regime, is proposed to be provided.

Personal Income Tax:

- Those opting for the new tax regime will get following benefits:

- The standard deduction for salaried employees is proposed to be increased from ₹50,000/- to ₹75,000/-.

- Deduction on family pension for pensioners is proposed to be enhanced from ₹ 15,000/- to ₹ 25,000/-.

- In the new tax regime, the tax rate structure is proposed to be revised, as follows:

Scholars’ analysis:

Gautam Chikermane:

According to him, Nirmala Sitharaman’s seventh Union Budget expresses a mature balance. It has quickly shifted from its pre-elections stance of all being well and has focussed on the underlying political narrative handed to it by Mandate 2024—jobs.

- Apart from the usual land-labour-capital as factors of production, she has included entrepreneurship and technology as new factors.

- She has focused on huge skilling proposal that includes financing internships in India’s top 500 companies and expands the scope of CSR (corporate social responsibility) funds to skilling and interning.

- Unique Land Parcel Identification Number or “Bhu-Aadhaar” for all lands; digitisation of lands; the establishment of land registry; and linking it to the farmers’ registry.

- Urban areas, she proposes an IT-based system for property record administration, updating, and tax administration.

- Jan Vishwas (Amendment of Provisions) Act, 2023, which decriminalised 183 provisions, of which 113 applied to doing business account for less than the tip of an iceberg: It is 0.4 percent of the total 26,134 imprisonment clauses businesses face—26,021 clauses remain to be rationalised. These provisions have become a tool for rent seeking and corruption in the hands of the bureaucracy.

- The tyranny of tax targets on the one side and unchecked corruption and unaccountable bureaucracy on the other, may make government efforts to stop tax terrorism easier said than done.

The budget has been missing the biggest focus of Modi government that must be carried out. In February 2021, Sitharaman had announced a policy on strategic disinvestment. Under this policy, four sectors—atomic energy, space and defence, transport and telecommunications; power, petroleum, coal and other minerals; and banking, insurance and financial services—would be strategic and have “bare minimum” public sector presence, with the rest being in the private sector. The rest would be privatised, merged or shut down.

Nilanjan Ghosh:

The co-movement of consumption growth and GDP growth seemed to have snapped with GDP growing at 8.2 percent, while consumption grew at only 4 percent. Rather, economic growth seems to have been spurred by growth in gross fixed capital formation or investment, which grew by almost 9 percent.

- The standard deduction given in the budget and the redefinition of tax slabs will be more visible for lower income households. It means that people with more propensity to consume get benefits rather than the people with more propensity to save (investment and funds for loans).

Ajoy Ashirwad Mahaprashasta:

He has argued that this budget is continuation of Modi government’s policy of taxing the middle class while giving free run to the rich. For example, it removes indexation from the LTCG tax on property that may spell doom for the real estate sector, as investors will prefer cash transactions over legitimate deals. Also, the swing traders in the share market, a majority of whom earn less than Rs 50,000 in a month, will now have to pay much more in taxes than earlier. But at the same time, the budget has slashed corporate tax for foreign companies from the existing 40% to 35% to incentivise foreign investments.

The budget does nothing for inequality rather only intensify the already growing inequality in India, with the poor and the middle classes forced to pay heavily even for necessary household consumption and investments made for long-term savings.

The announcements related to proposed performance-linked incentives, apprenticeships and the skilling of young people to improve India’s poor employment rate sound hollow considering no or negligible direct support to public education and health sectors.

Union budget clearly mirrored the political exigencies of the new Modi government that is dependent on its allies. A slew of announcements for N. Chandrababu Naidu-led Andhra Pradesh and Nitish Kumar-led Bihar clearly indicates that.